How To - Entering Petty Cash Purchases

To maintain accurate financial information, all petty cash purchases must be entered into Aztec.

If the money has come from a till, this receipt would be treated as cash when the till is declared. These purchases must then be entered as a miscellaneous expense in order to correct the cash on site figure

To enter a petty cash purchase:

-

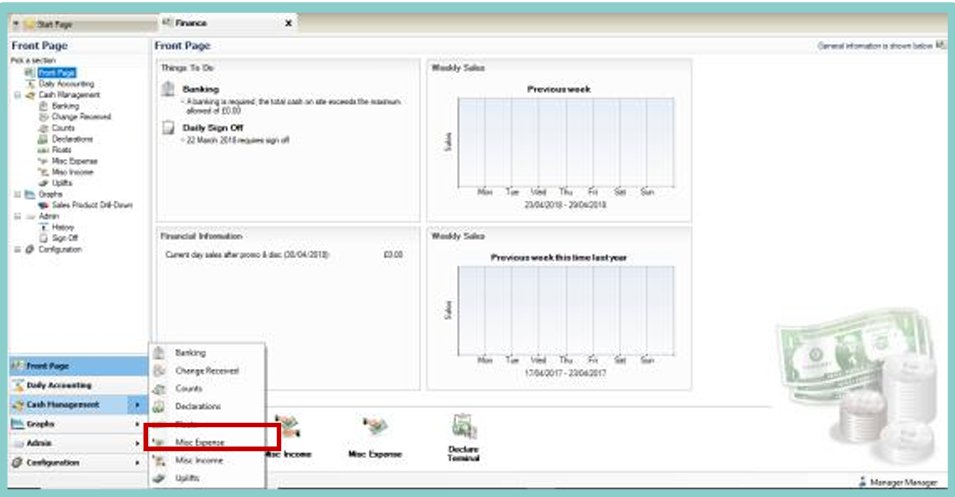

Select Finance from the Aztec Start Page

-

Select Cash Management and Misc Expenses from the dropdown list

-

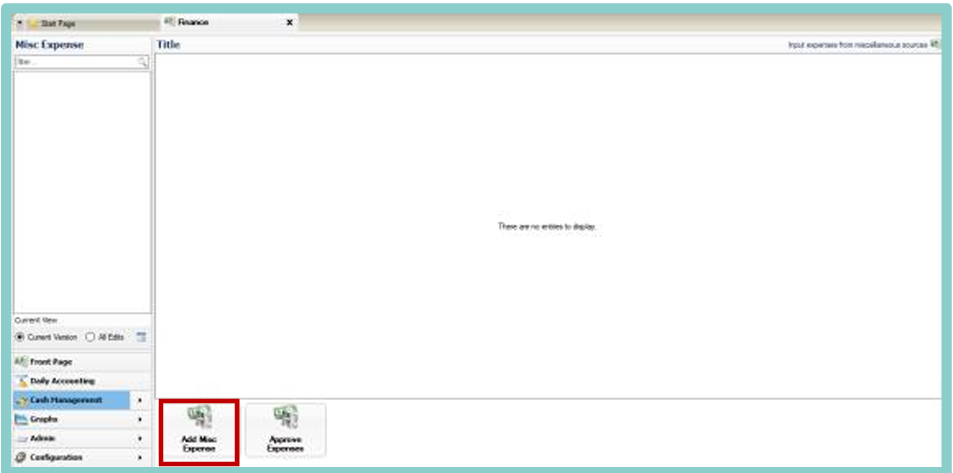

Select Add Misc Expense

-

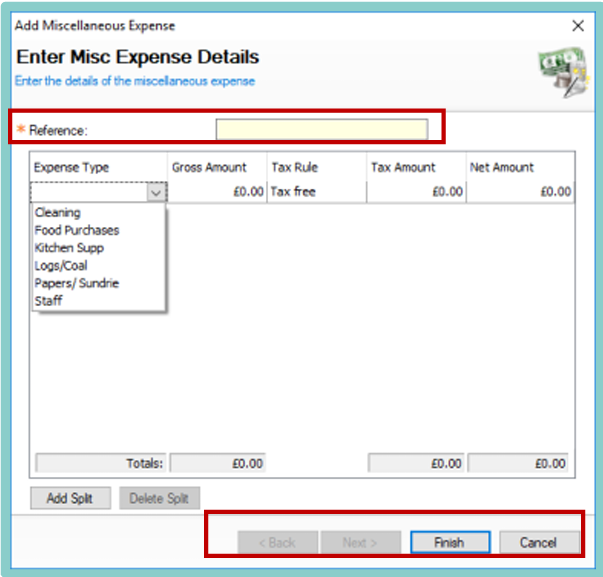

Enter the mandatory reference of the purchase; this is usually what the item is or where it was purchased from.

-

Select the appropriate expense type and enter the gross amount of the purchase. This is the total cash value of the receipt. Aztec will then work out the amount of VAT paid on this purchase.

-

Confirm the Misc Expense entry by selecting Finish.

-

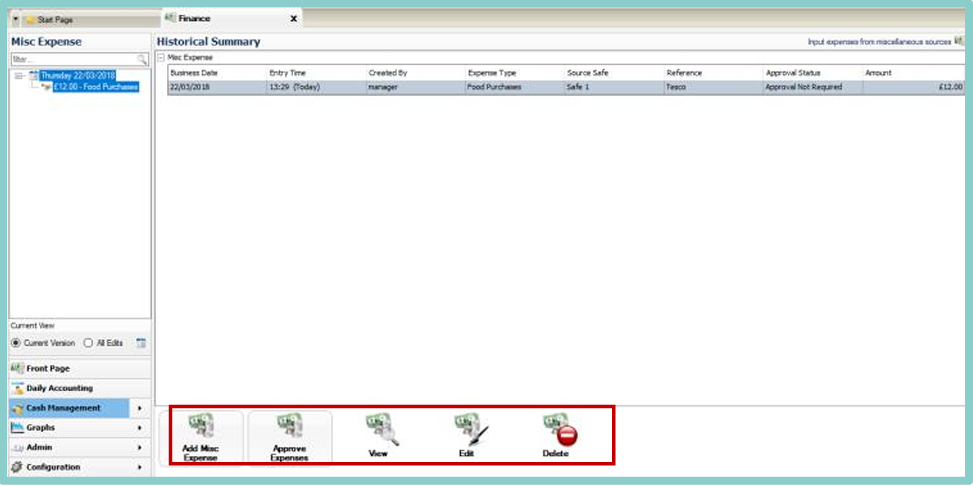

The petty cash purchase is now visible and can be viewed in more detail, edited or deleted if needed.

The entered Petty Cash Purchase is now visible on the Count Variance line on both the Daily Summary and the 7 Day Statement of Trade.